Limit Order Xervices

Limit monitoring system

Trading

L.O.X. is a limit monitoring system for the OTC limit order trade with the respective issuers. Based on a bilateral contractual relationships between brokers and issuers, brokers can place good for day and long term market, limit, stop-/stop limit, trailing stop and OCO orders on L.O.X. The trade is always done bilaterally between broker and one of the issuers.

As the operator of the limit order management system L.O.X. Xervices acts as an independent party. This guarantees that the issuers will not get insight to the order book positions. Currently investors can trade around 2 million various derivative products. Namely investment products, i.e. certificates, such as bonus, index and discount certificates, structured bonds, such as convertibles, as well as leveraged products, i.e. warrants and knock-out warrants.

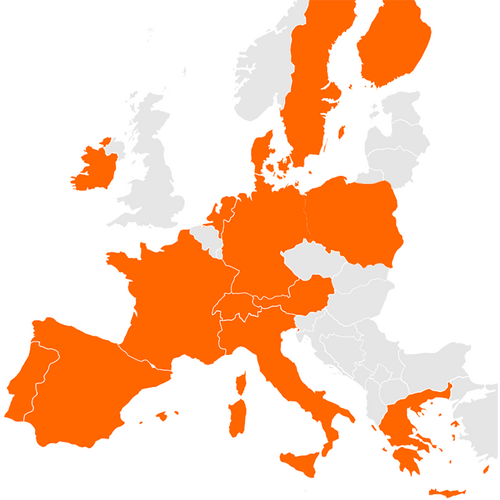

Connected brokers

The most important brokers from the DACH region, Sweden, France, Portugal, Spain, Italy and Ireland (in total 29 brokers).

Technology

L.O.X. currently supports FIX standard 4.2 and 4.4. Based on release LOX04 L.O.X. was certified in compliance with IDW testing standard for software products 880. As of release LOX06 it provides a web-based frontend (iLOX) which allows online-brokers to display, enter, modify or cancel L.O.X. orders. User access to iLOX is secured by a strong authentication.